Supply chain disruptions, labor shortages, raw material price inflation, ESG requirements, tariffs and other geopolitical changes – the auto industry was already facing massive and rapidly changing challenges. The situation between Russia and Ukraine – beyond the humanitarian implications – is compounding these challenges in a dramatic and unprecedented way.

供应链中断、劳动力短缺、原材料价格上涨、ESG 要求、关税和其他地缘政治变化——汽车行业正在面临巨大且瞬息万变的挑战。而乌克兰局势——除了其人道主义影响之外——正在前所未有的方式加剧这些挑战。

Responding to several questions from stakeholders in the industry, we put together some facts and data to describe the impact of the crisis in Ukraine on the automotive industry. We analyzed the situation from three dimensions: OEMs, suppliers, and raw materials.

针对行业从业者提出的几个问题,我们汇总了一些事实和数据来描述乌克兰危机对汽车行业的影响,并从OEM、供应商、原材料三个维度开展了分析。

OEMs

Many Western and Asian OEMs need to ask themselves about the risk exposure for their organizations in case they must cease doing business in Russia.

欧美和亚洲OEM需要判断在停止俄罗斯业务后所会面临的潜在风险。

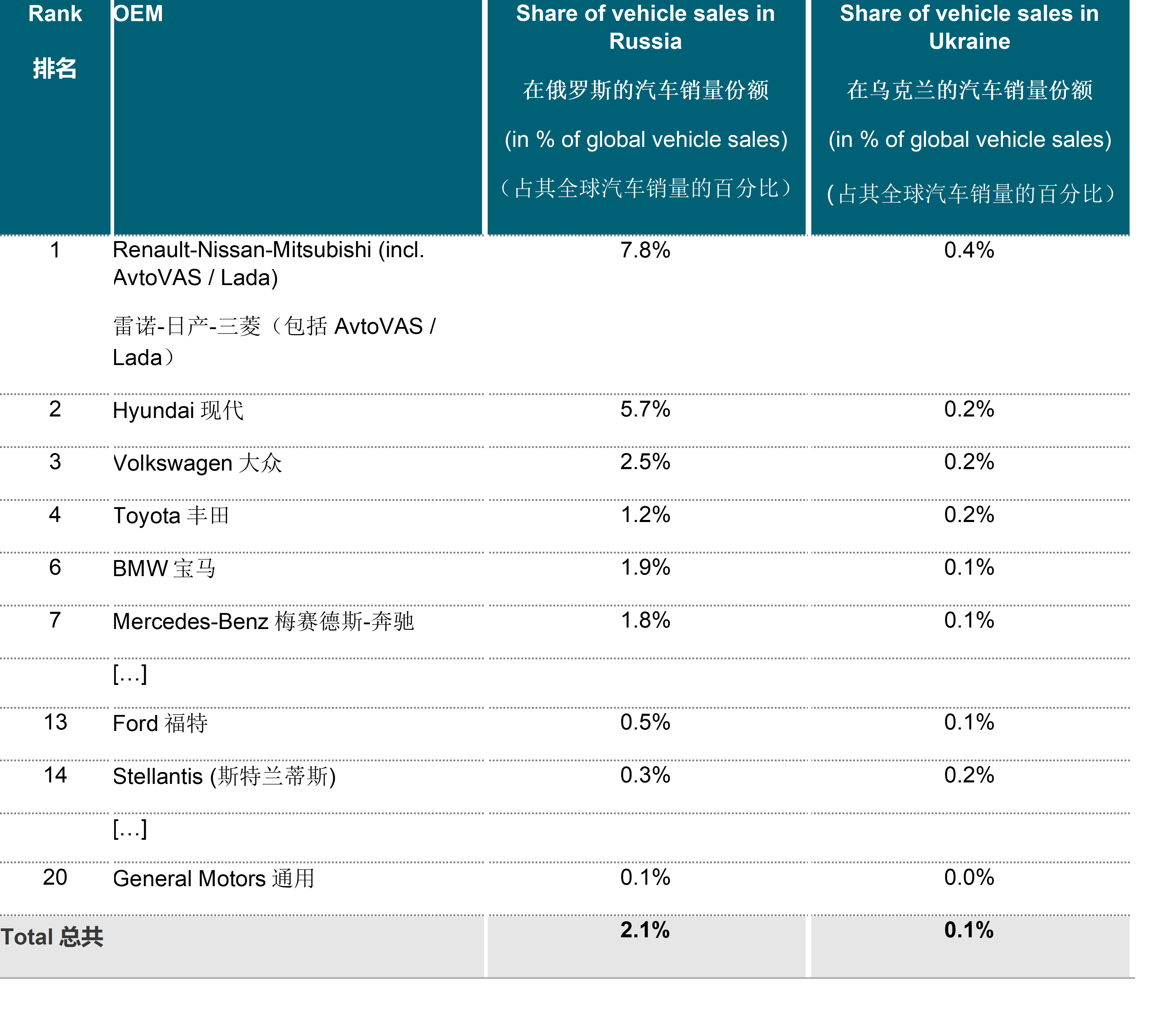

In 2021, Russia represented 2.1% of all vehicles sold globally, with Ukraine representing 0.1%. Based on sales figures, Renault-Nissan-Mitsubishi, Hyundai, and Volkswagen are among the top selling OEMs in Russia. With nearly 8% of global sales in Russia and 0.4% in Ukraine, Renault-Nissan-Mitsubishi has the highest share of vehicles sold in Russia and Ukraine, primarily due to the company’s ownership in AvtoVAZ / Lada. Hyundai sold nearly 6% and Volkswagen 2.7% of their vehicles in Russia and Ukraine. U.S. OEMs have significantly smaller sales volumes in Russia and Ukraine.

在2021年,俄罗斯与乌克兰分别占全球汽车销量的 2.1%及 0.1%。根据销售数据显示,俄罗斯销量排名前三的OEM为雷诺-日产-三菱、现代和大众。雷诺-日产-三菱在俄罗斯和乌克兰的销量占其全球销量的近 8% 和 0.4%,也是俄罗斯和乌克兰最畅销的OEM。这主要得益于其旗下的AvtoVAZ / Lada品牌。此外,俄罗斯和乌克兰分别贡献了现代和大众的6%及2.7%的销量,而美国OEM在俄罗斯和乌克兰的销量则要小得多。

Table 1: Vehicle sales of traditional OEMs in Russia and Ukraine in % of their global vehicle sales

图表 1:主要OEM在俄罗斯和乌克兰的汽车销量占其全球总销量的百分比

Source: AlixPartners analysis

来源:艾睿铂分析

Most OEMs announced the halt of exports into Russia as well as imports of vehicles from Russia. Investments are also suspended.

大多数OEM已经宣布了停止向俄罗斯出口以及从俄罗斯进口汽车,并暂停了相关投资。

Looking at vehicle production, Russia produces approximately 2% of global vehicles. Given the local production footprint for AvtoVAZ/Lada as well as additional assembly plants for Renault vehicles, Renault-Nissan-Mitsubishi’s production is significantly impacted by the current situation in Russia. Hyundai and Volkswagen maintain production plants at several locations in Russia, however, primarily serving local demand in Russia. Other OEMs, including BMW or Mercedes-Benz, produce most of their vehicles sold in Russia outside of Russia.

从产量来看,俄罗斯生产了全球大约 2%的汽车。由于雷诺-日产-三菱旗下在俄罗斯及乌克兰拥有制造网络,包括了旗下AvtoVAZ/Lada 品牌的本地生产网络以及雷诺品牌的装配厂,其生产受到了俄罗斯当前局势的重大影响。 另外,现代和大众在俄罗斯的多个地点也设有制造工厂,主要以满足俄罗斯当地的需求。而宝马和梅赛德斯-奔驰在内的其他OEM在俄罗斯销售的车型则都是通过进口。

Ukraine does not have any significant vehicle production.

就乌克兰而言,其境内的汽车产量较少,因而影响并不显著。

Suppliers供应商

Twenty-two foreign automotive suppliers invested $600 million in 38 production sites in Ukraine since 1998. These sites employ approximately 60,000 people. Most of these production sites are in the Western part of Ukraine with proximity to OEM plants in Slovakia, Hungary, Poland, Romania, the Czech Republic, or Germany.

自1998 年以来,22 家外国汽车供应商为其在乌克兰的38个制造基地投资了 6 亿美元。这些工厂拥有雇员约6万名,大部分位于乌克兰西部,靠近斯洛伐克、匈牙利、波兰、罗马尼亚、捷克或德国的 OEM 工厂。

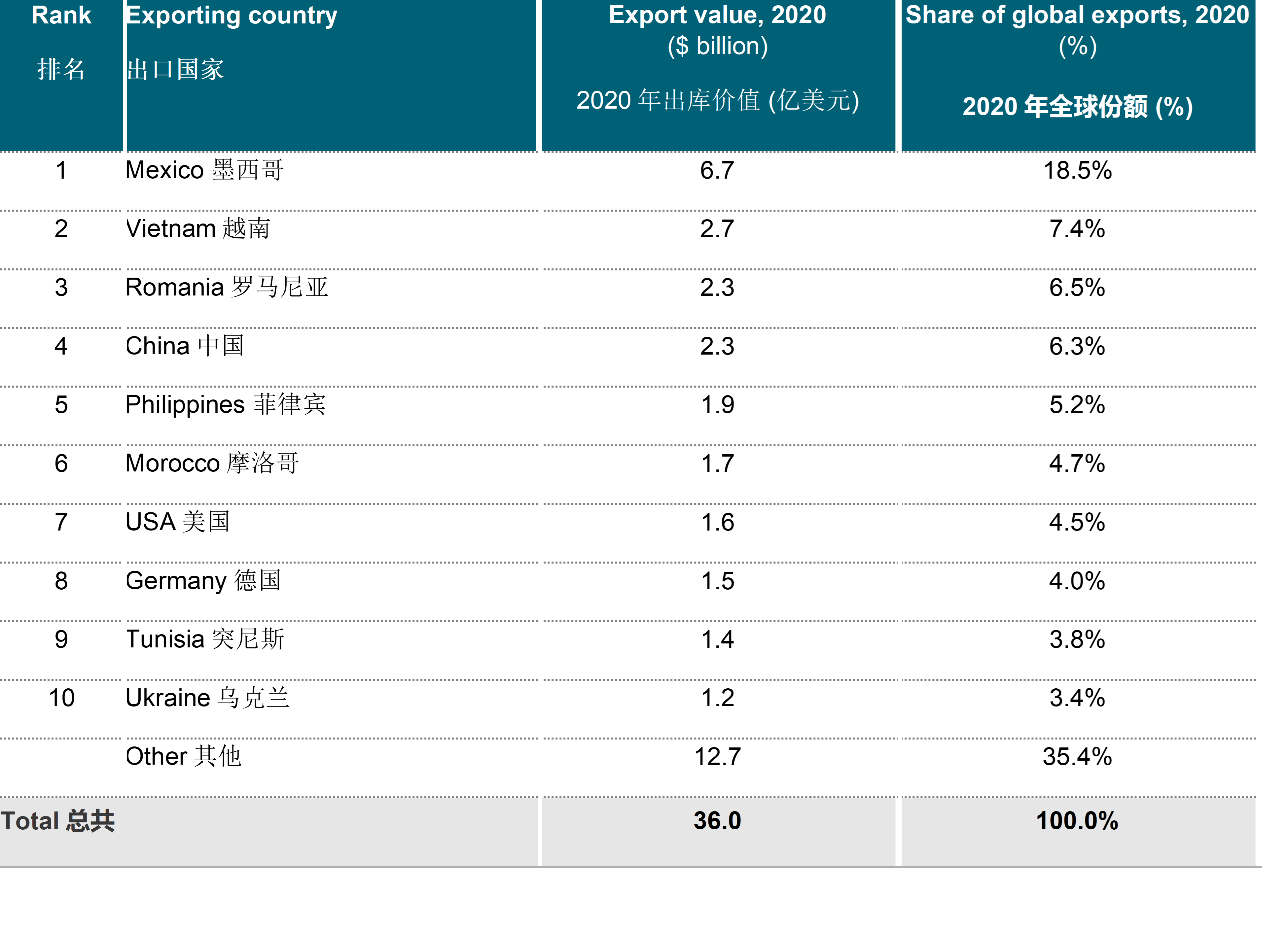

Wire harnesses represent by far the largest share of these suppliers in Ukraine (11 of 22 suppliers), including corresponding suppliers for wires, connectors, and electronic components. Nearly all the Top 10 global wire harness manufacturers have at least one assembly line in Ukraine. Ukraine ranks number 10 for all wire harness exporting countries globally (3.4% of global wire harness sales), mainly due to wire harness manufacturing having a high labor content – especially for highly individualized wire harnesses – as well as due to Ukraine’s relatively low wage levels.

在这些位于乌克兰的供应商中,占最大比例的是线束相关的厂家(22 家供应商中的 11 家),包括电线、连接器和电子元件的相应供应商。几乎所有全球十大线束制造商都在乌克兰拥有至少一条装配线,而乌克兰在全球所有线束出口国中排名第 10 位(占全球线束销售额的 3.4%)。主要因为线束为劳动力密集型产业(尤其是对于高度客制化配置的线束),而乌克兰的工资水平又相对较低。

Table 2: Export value of wire harnesses, by exporting country, 2020

图表 2:2020 年按出口国排序的线束出口值

Source: UN COMTRADE, ITC statistics

来源: UN COMTRADE, ITC statistics

North American OEMs appear to be far less impacted than their European counterparts, given that they source wire harnesses almost entirely from Mexico, with some supply either being domestic production or coming from Asia. Some components might be sourced from Europe, but exposure to Russia and Ukraine is limited.

北美 OEM 受到的影响似乎远小于欧洲同行,因为它们几乎完全从墨西哥采购线束,而其余部分则来自国内生产或来自亚洲。一些组件可能来自欧洲,但与俄罗斯和乌克兰的关联度有限。

Besides wire harnesses, other suppliers in Ukraine produce electronics (4 suppliers), seats (3 suppliers), plastic products (2 suppliers), heating systems (1 supplier), and car starters (1 supplier).

除线束外,乌克兰的其他供应商主要生产电子部件(4 家供应商)、座椅(3 家供应商)、塑料制品(2 家供应商)、加热系统(1 家供应商)和汽车点火器(1 家供应商)。

The main chance to avoid supply shortages from Ukraine is currently the relocation of production and assembly. Some suppliers already anticipated potential disruptions several months ago and changed their sourcing approach for several components out of Ukraine. The most significant challenges for short-term relocations include the availability and training of personnel, the relocation of assembly boards, as well as test equipment.

目前避免乌克兰供应短缺的主要措施是迁移相关的生产组装产能。一些供应商在几个月前就已经预料到了潜在的供应链中断,并改变了采购方式,开始从乌克兰之外采购一些组件。短期内生产迁移所面临的最大挑战包括工人的可用性和培训、装配板的搬迁以及测试设备。

Raw Materials原材料

Neon氖

Neon is used, among other things, in lighting technology, but above all—with about 50% of global consumption—for the operation of helium-neon lasers. High-purity neon makes up 96% of the gas in He-Ne lasers, which are used in lithography worldwide to make semiconductors by etching circuit patterns onto wafers of silicon.

氖,除了用于照明技术外,最重要的用途是用于氦氖激光器(约占全球消耗量的 50%)。氦氖激光器在全球范围内用于光刻技术,即通过在硅晶片上蚀刻电路图案来制造半导体,而该激光器所用气体的96%正是高纯度氖气

Ukraine is the largest exporter of neon globally. This has historic reasons primarily relating to Russian steel production. In the Soviet era, many Russian steel plants—most of them still in use today—were equipped with air separation units capable of capturing neon. Neon as a by-product from steelmaking needs further processing and purification to be transformed into high-purity neon. The major purifiers for Russian and Ukrainian neon are in Ukraine, specifically in Odessa (Cryoin, Iceblic) and Mariupol (Ingas).

由于苏联钢铁生产的历史原因,乌克兰目前是全球最大的氖气出口国。在苏联时代,许多钢铁厂——其中大部分至今仍在运营——都配备了能够获取氖气的空气分离装置。但氖作为炼钢的副产品,需要进一步加工和提纯才能转化为高纯度氖,而俄罗斯和乌克兰范围内主要的氖气提纯工厂正位于乌克兰境内,特别是在敖德萨(Cryoin、Iceblic)和马里乌波尔(Ingas)。

Semiconductor manufacturers already learned from Ukraine / Crimea conflict in 2014 to reduce their dependence on neon and Ukraine, and they started to implement a set of changes:

- Process improvements leading to lower neon consumption during semiconductor production

- Changing suppliers and thus supplying neon from non-Ukrainian production, such as South Korean chipmaker SK Hynix – "South Korea sources less than 5% of its neon from Ukraine" (according to Wired UK, February 28, 2022)

- Building safety stock of up to 6 months

半导体制造商已经从 2014 年的乌克兰/克里米亚冲突中吸取教训,并实施了一系列变革以减少对氖和乌克兰的依赖:

- 通过改进工艺来减少半导体生产过程中所需的氖消耗量

- 通过更换供应商,从其他国家采购氖,例如韩国芯片制造商 SK 海力士就宣称“韩国从乌克兰采购的氖不到 5%”(据英国连线报道,2022 年 2 月 28 日报道)

- 储存足够用6 个月的安全库存

Chip manufacturers are still confident that neon supply disruptions are unlikely to have a significant near-term impact. However, if the conflict between Ukraine and Russia continues for a longer period, there could be significant supply bottlenecks for neon and a renewed crisis in global chip production on the horizon.

芯片制造商仍然相信,氖的供应中断不太可能在短期内产生重大影响。然而,如果乌克兰和俄罗斯之间的冲突持续的话,氖的供应可能会出现严重瓶颈,而这可能导致全球芯片生产面临新的危机。

The automotive industry is merely a bystander but could once again suffer the consequences. Automotive companies now need to closely monitor the chip manufacturers’ ability to deliver as well as their inventory levels. Establishing significant neon production outside Ukraine should also be monitored.

汽车行业并不直面冲击,但仍可能会再次遭受严重后果。汽车公司现在需要密切监控芯片制造商的交付能力以及库存水平,并应持续性监测在乌克兰之外建立的的氖气生产基地。

Palladium钯

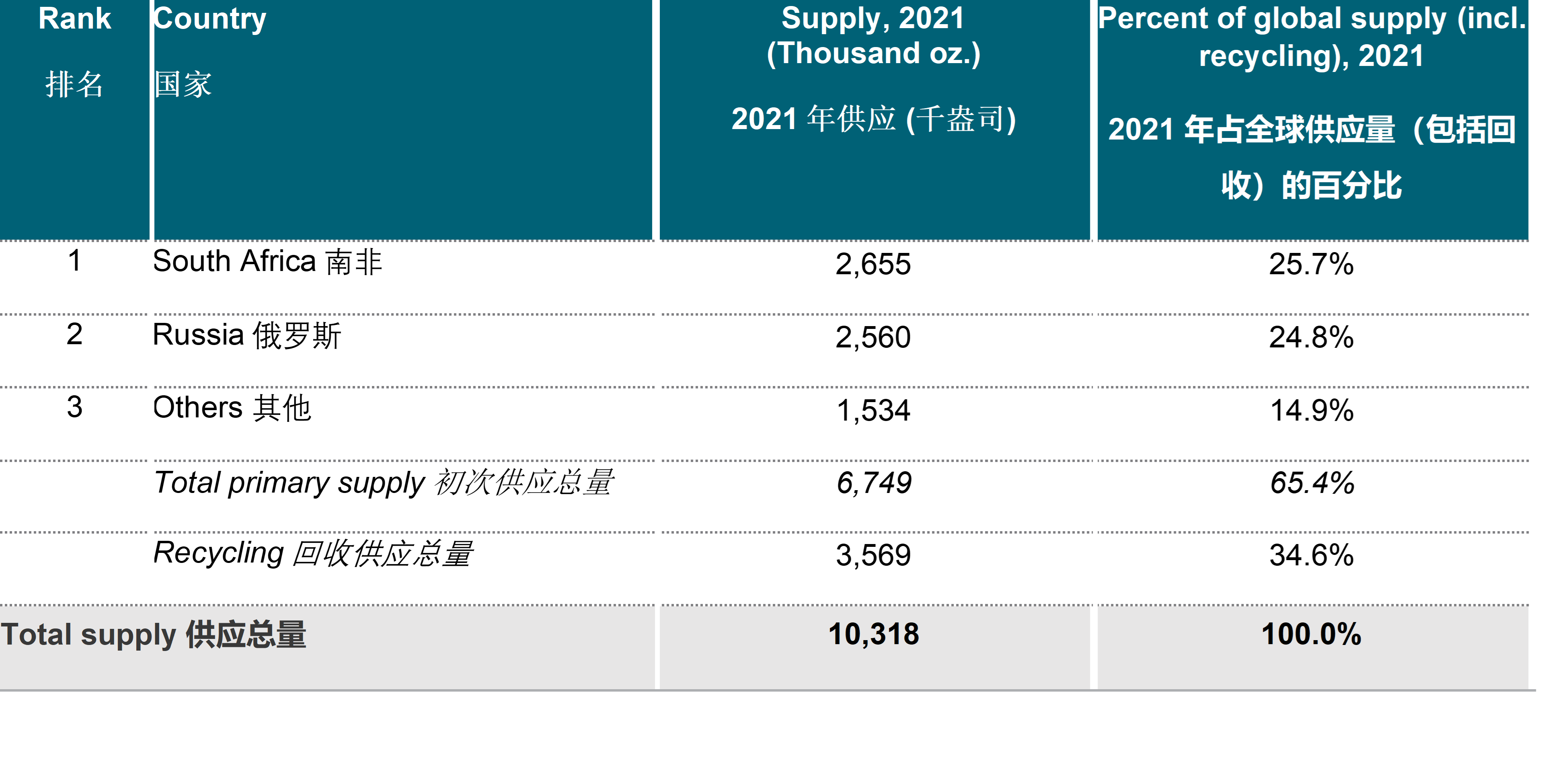

South Africa and Russia are among the largest producers of palladium globally. Russia’s share of global supply (including recycling sources) accounts for 24.8%.

南非和俄罗斯是全球最大的钯生产国之一。,其中俄罗斯在全球供应(包括回收资源)中的份额为24.8%。

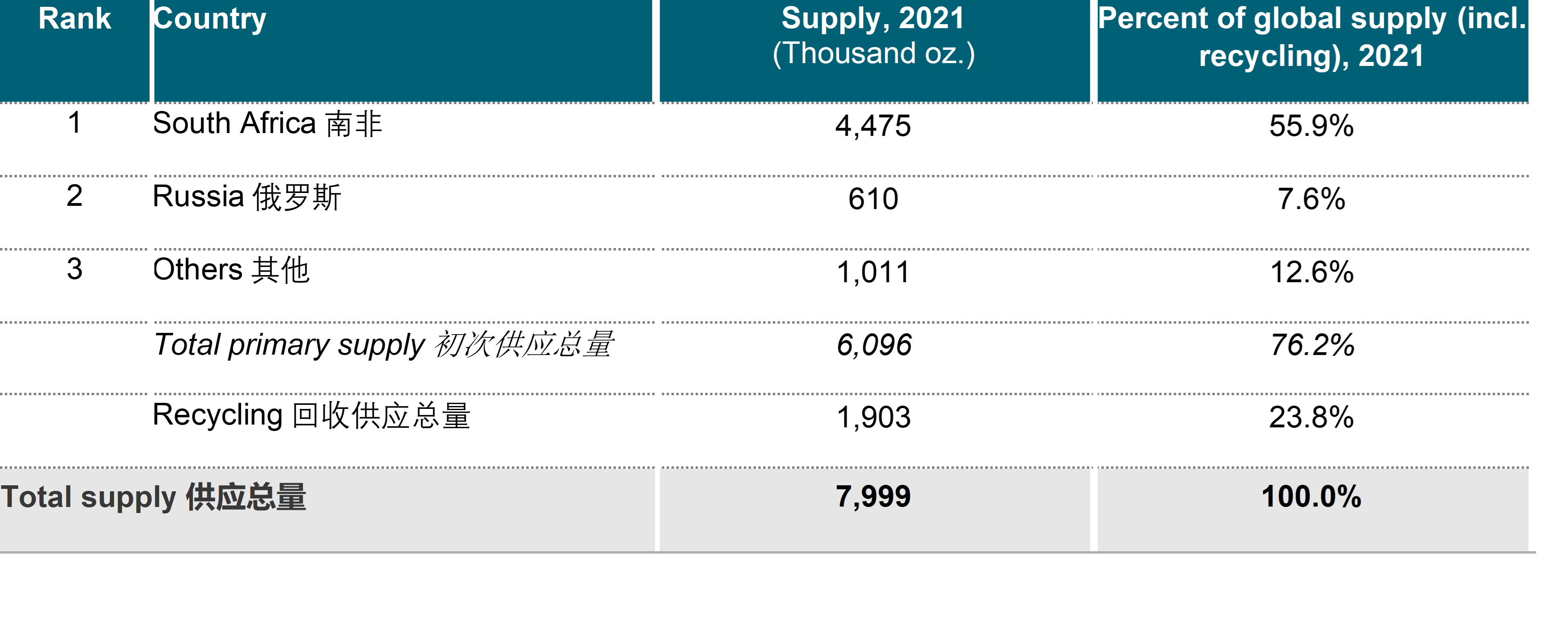

Table 3: Palladium supply (including recycling) by country, 2021

图表 3:2021 年各国钯的供应(包括回收)

Source: Johnson Matthey, 2021

来源: 庄信万丰, 2021

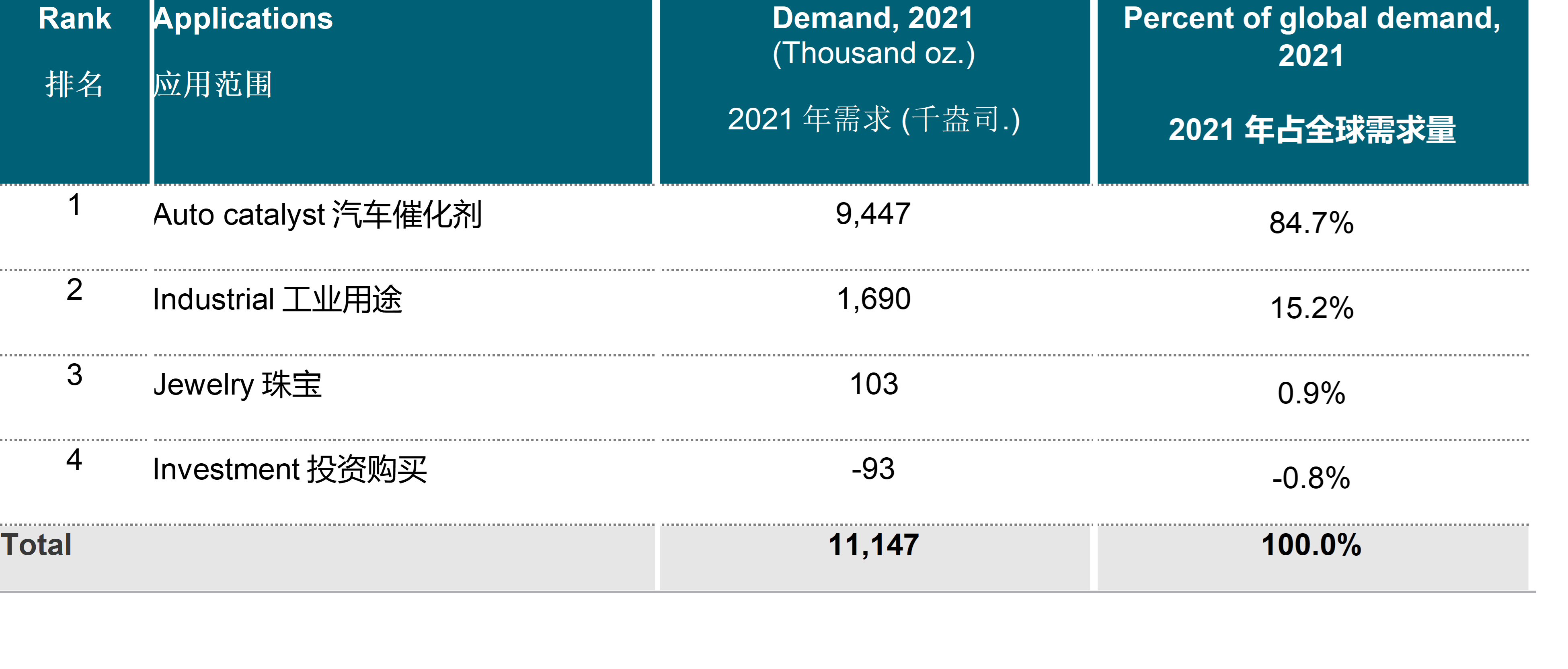

In 2021, the world’s largest consumers of palladium were exhaust manufacturers, accounting for 85% of global demand.

2021年,全球最大的钯金需求领域是用于汽车尾气排放系统,占全球需求的85%。

Table 4: Global demand of Palladium by application, 2021

图表 4:2021 年按应用范围分列的全球钯需求

Source: Johnson Matthey, 2021

来源: 庄信万丰, 2021

The next weeks will reveal the true impact of current palladium inventory levels, whether a stoppage of supply of palladium from Russia is a real threat, and whether palladium from Russia can be replaced by other countries.

未来几周将会揭示当前钯库存水平真正意味着什么:俄罗斯钯供应的停止是否是一个真正的威胁,以及俄罗斯的钯是否可以被其他国家取代。

Platinum铂

South Africa is by far the largest producer of platinum in the world, with the Bushveld Igneous Complex (BIC) providing the world’s largest reserves of platinum group metals. Russia is the second largest producer of platinum. Including recycling, Russia provides 7.6% of global supply.

南非是迄今为止世界上最大的铂生产国, Bushveld Igneous Complex提供了世界上最大的铂族金属储量。而俄罗斯是第二大铂生产国。包括回收在内,俄罗斯占据了全球供应量的 7.6%。

Table 5: Platinum supply (including recycling) by country, 2021

图表 5:2021 年各国铂供应量(包括回收)

Source: Johnson Matthey, 2021

来源: 庄信万丰, 2021

The world’s largest consumers of platinum in 2021 were auto catalysts / exhaust systems with 39.4%, industrial applications with 32.0%, and jewelry manufacturers with 24.3%.

2021 年全球最大的铂消费行业是汽车催化剂/排气系统,占 39.4%,工业应用占 32.0%,珠宝制造商占 24.3%。

Pig iron生铁

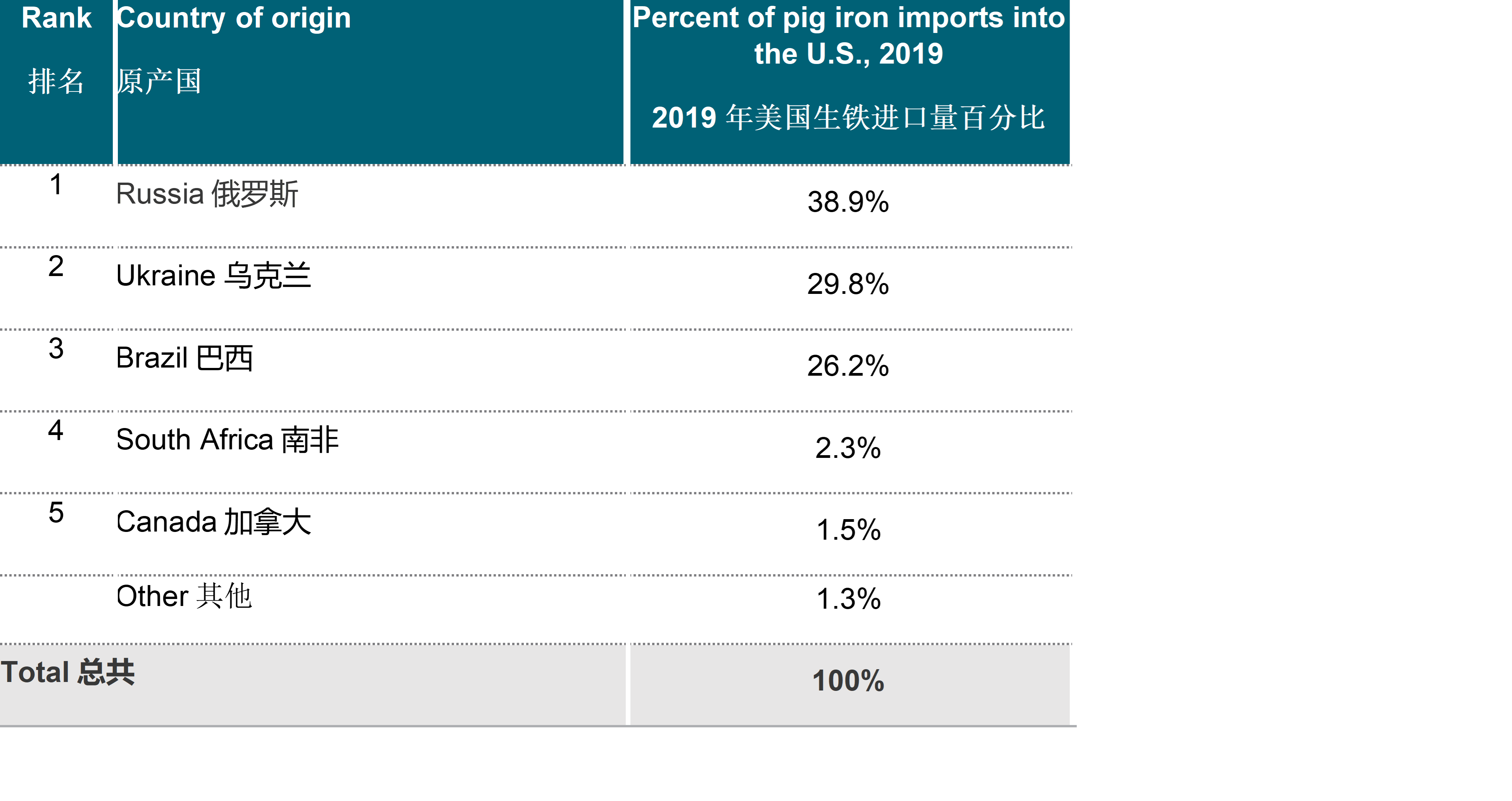

Pig iron is used as a raw material in electric arc furnace (EAF)-based steelmaking. Approximately 70% of steel production in North America is EAF-based, and pig iron represents up to 20% of each heat. U.S. steelmakers have traditionally imported significant pig iron volumes from Russia (38.9% of total imports in 2019) and Ukraine (29.8% of total imports).

生铁是电弧炉 (EAF) 炼钢的原料之一。北美大约 70% 的钢铁生产是基于 EAF,生铁可占到每炉的20%。美国钢铁制造商在过往从俄罗斯(占 2019 年总进口量的 38.9%)和乌克兰(占总进口量的 29.8%)进口了大量生铁。

Table 6: Pig iron imports into the U.S. by country of origin, 2019

图表 6:2019 年按原产国分列的美国生铁进口量

Source: Observatory of Economic Complexity (OEC)

来源: Observatory of Economic Complexity (OEC)

With nearly 70% of total pig iron imports into the U.S. being directly impacted by the situation in Russia and Ukraine, steelmakers either must switch to pig iron from Brazilian sources or use alternative materials, such as DRI (direct reduced iron) or HBI (hot briquetted iron), in addition to increasing the amount of scrap used in the furnace. As a result, steel prices have seen a significant increase already over the last couple of weeks, with forward prices for hot rolled coil steel (U.S. Midwest) reaching $1500/ton, up from approximately $900/ton just a few weeks ago.

由于近 70% 的美国生铁进口总量直接受到俄罗斯和乌克兰局势的影响,钢铁制造商要么必须改用来自巴西的生铁,要么使用替代材料,例如 DRI(直接还原铁)或 HBI(热压块铁),此外还可以增加熔炉中使用的废料量。因此,过去几周钢材价格已经出现大幅上涨,热轧卷钢(美国中西部)的远期价格从几周前的大约 900 美元/吨上涨到 1,500 美元/吨。

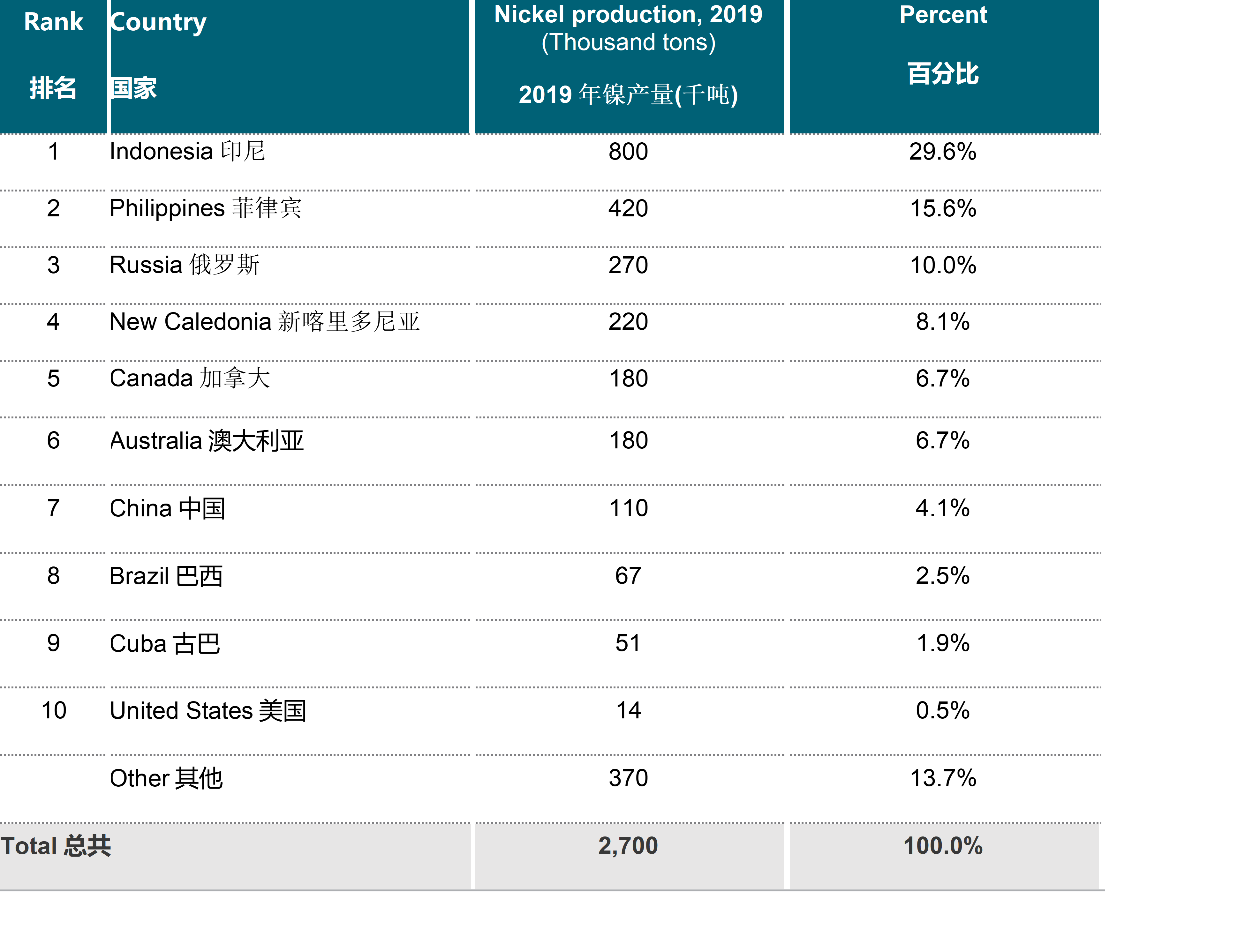

Nickel镍

Russia is the third largest producer of nickel, accounting for 10% of global nickel production. Indonesia with 29.6% and the Philippines with 15.6%, each produce more nickel than Russia.

俄罗斯是世界第三大镍生产国,占全球镍产量的 10%,而位居第一第二的分别是印度尼西亚 (29.6%)和菲律宾 (15.6%)

Traditionally used as an alloying element in steel production to make stainless steels and other alloy steels, Nickel is increasingly in demand in the fast-growing electric vehicle market, as it is an important raw material for electric vehicle batteries, accounting for more than 10% of the cost. Russia has the largest mining production of Battery-grade (Class 1) nickel globally and ranks second in refined production for Class 1 nickel, after China.

传统上,镍作为一种合金元素被用于制造不锈钢和其他合金钢。同时,镍还是电动汽车电池的重要原材料,在成本中占比超过10%。因此,随着电动汽车市场快速增长,汽车行业对镍的需求量越来越大。因为,而俄罗斯拥有全球最大的电池级(1 类)镍采矿产量,在1 类镍的精炼产量中排名第二,仅次于中国。

Recent spikes in the price of nickel, including a short squeeze pushing the price to over $100,000/ton just over a week ago, have caused significant anxiety in the market. Prices have come down to approximately $42,000/ton, but they remain significantly elevated compared to historical averages.

近期镍价飙升,包括一周多前将价格推高至 100,000 美元/吨以上的空头挤压,已在市场上引起了极大的焦虑。尽管价格目前已降至约 42,000 美元/吨,但与历史平均水平相比仍处高位。

Table 7: Nickel production by country, 2019

图表 7:2019 年各国镍产量

Source: U.S. Geological Survey

来源: 美国地质调查局

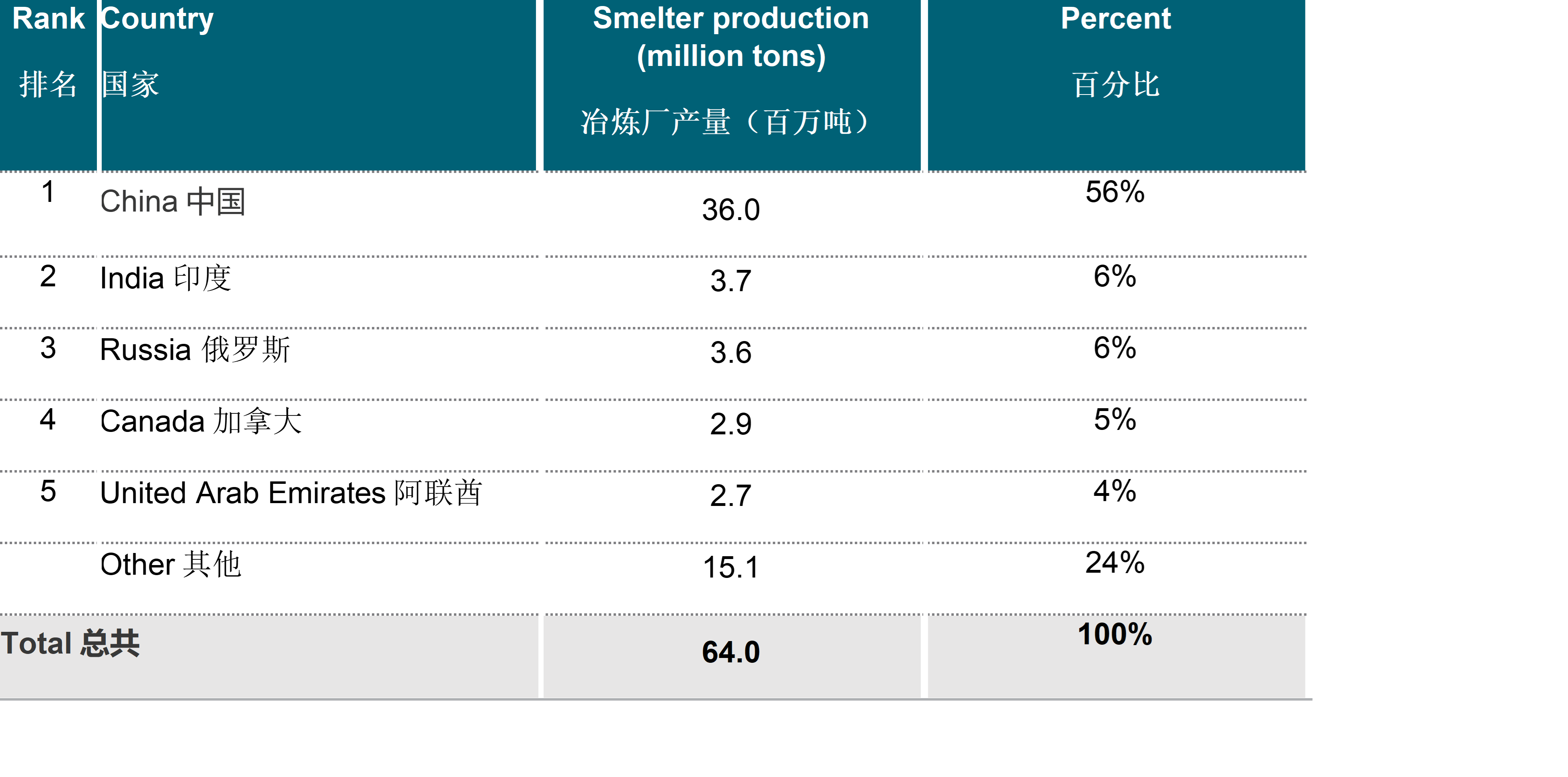

Aluminum铝

Russia is a significant producer of primary aluminum in the world, even though significantly behind China in terms of smelter production volumes. As of 2019, Russia ranked #3 globally with 3.6 million tons of aluminum smelter production, compared to 36 million tons for China.

俄罗斯是世界上最重要的原铝生产国之一,尽管在冶炼厂产量方面远远落后于中国。截至 2019 年,俄罗斯以 360 万吨铝冶炼厂产量位居全球第三,而中国为 3,600 万吨。

However, the situation in Ukraine is expected to further squeeze an already tight global supply of primary aluminum, driving up aluminum prices (LME) by approximately 20% since the beginning of 2022. Chinese supply into global markets remains challenged due to issues relating to the Chinese energy crisis as well as recent surges in Covid-19 cases. Having other European countries pick up the volume appears to be challenged by energy policy uncertainty and challenges around natural gas prices and low-cost electricity in Europe. Meanwhile, the United States is the 3rd largest consumer of aluminum globally and will likely further need to tap into Canada’s production capacity which ranks #4 worldwide.

然而,乌克兰局势可能会进一步挤压本已紧张的全球原铝供应,自 2022 年初以来,铝价 (LME) 已经上浮约 20%。由于中国的能源危机以及近期新冠病例激增,中国对全球市场的供应仍面临挑战。与此同时,欧洲国家铝冶炼产能的提升很可能受限于欧洲能源政策的不确定性、天然气价格和电力成本的挑战。考虑到美国是全球第三大铝消费国,因此可能需要进一步利用加拿大在全球排名第四的铝冶炼产能。

Table 8: Global Aluminum smelter production by country, 2019

表 8:2019 年按国家分列的全球铝冶炼厂产量

Source: U.S. Geological Survey, Mineral Commodity Summaries, January 2020

来源:美国地质调查局,2020 年 1 月矿产商品摘要

Oil / Natural Gas石油/天然气

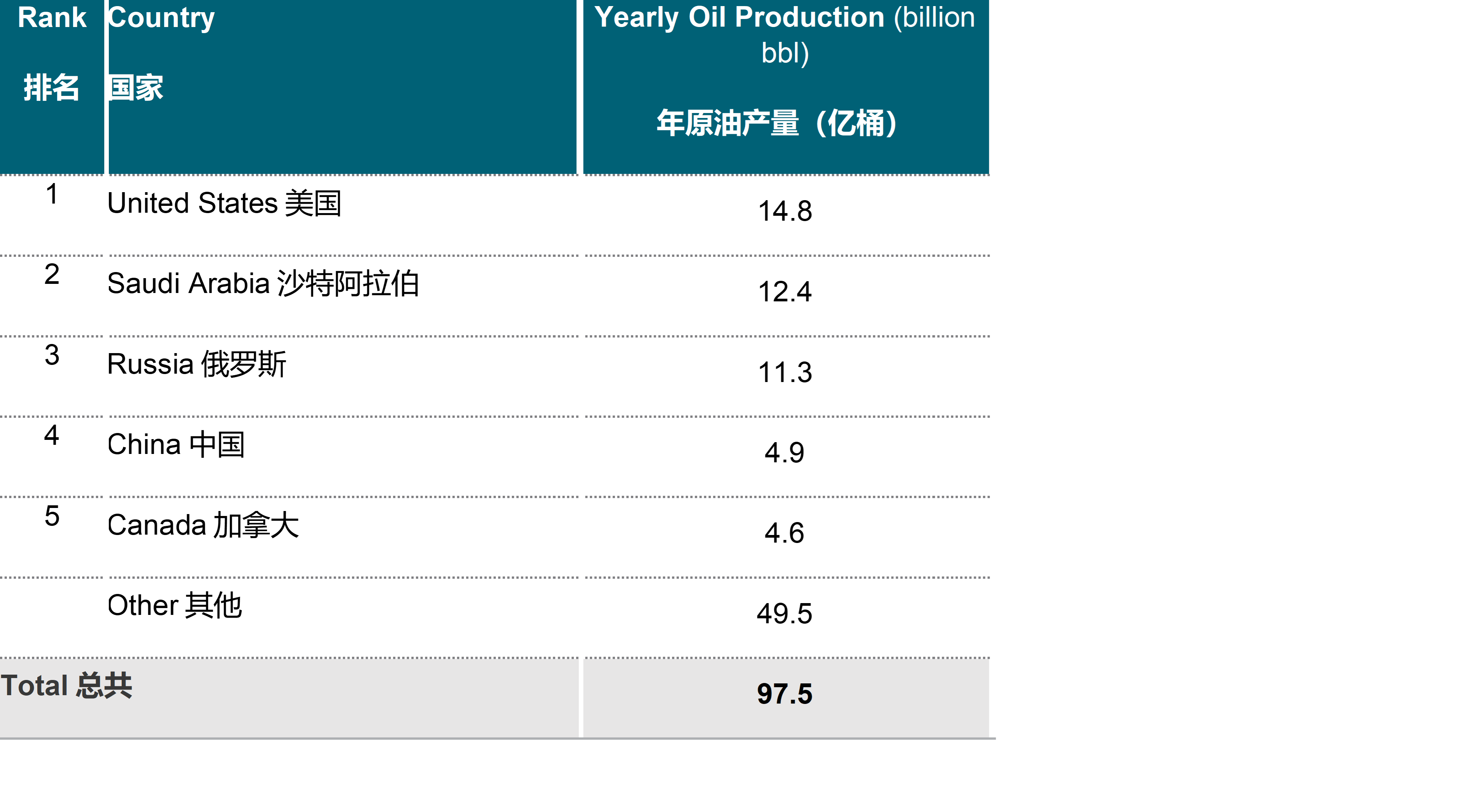

Producing over 11 billion barrels of petroleum annually, Russia ranks #3 in the world, accounting for 12% of global supply and trailing only the United States and Saudi Arabia, who control 15% and 13% of the global market.

俄罗斯每年生产超过 110 亿桶原油,位居世界第三,占全球供应量的12%,仅次于美国和沙特阿拉伯的15% 和13%。

Table 9: Oil production by country

图表 9:各国原油产量

Source: Worldometers

来源: Worldometers

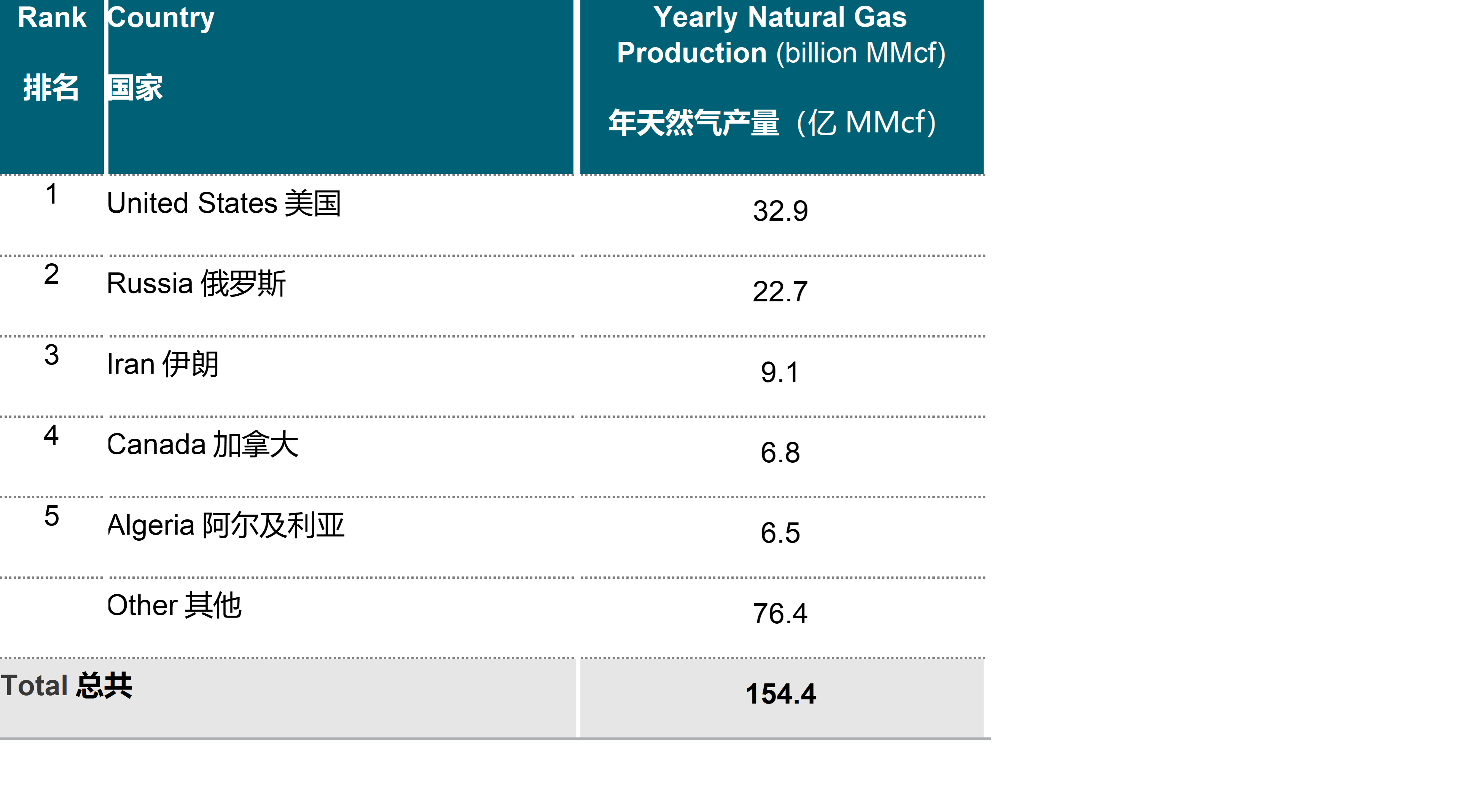

Russia is the #2 natural gas producer in the world with 22.7 billion MMcf and only lags the United States which produces nearly 33 billion MMcf. Especially Europe is relying on natural gas coming from Russia, primarily via the Nord Stream 1 pipeline, a 750-mile-long sub-sea pipeline connecting Russia and Continental Europe through the Baltic Sea; the commissioning of a second pipeline (Nord Stream 2) – that would have doubled capacity – was recently suspended.

俄罗斯是世界第二大天然气生产国,产量为 227 亿 MMcf,仅落后于生产近 330 亿 MMcf 的美国。欧洲目前高度依赖来自于俄罗斯的天然气。俄罗斯目前主要通过 Nord Stream 1 管道向欧洲输送天然气。这条 750 英里长的海底管道,通过波罗的海连接了俄罗斯和欧洲大陆; 但能将俄欧间天然气输送量翻倍的第二条管道Nord Stream 2的试运行,在最近刚因制裁而被暂停。

Table 10: Natural gas production by country

图表 10:各国天然气产量

Source: Worldometers

来源: Worldometers

Implications 影响

In addition to addressing the points mentioned above, we are currently helping OEMs and suppliers resolve urgent supply issues, address inflation in purchasing, product management and pricing, and reset supply chains for long-term resiliency. For a deeper dive, please contact:

除了解决上述问题外,我们目前还在帮助 OEM 和供应商解决紧迫的供应问题,着手于采购、产品管理和定价上浮方面问题,并重整供应链以持续保障其长期抗干扰性。 如需深入的探讨,请联系:

For more information, contact:

欲了解更多信息请联系:

Managing Director董事总经理

+86 21 6171 7572